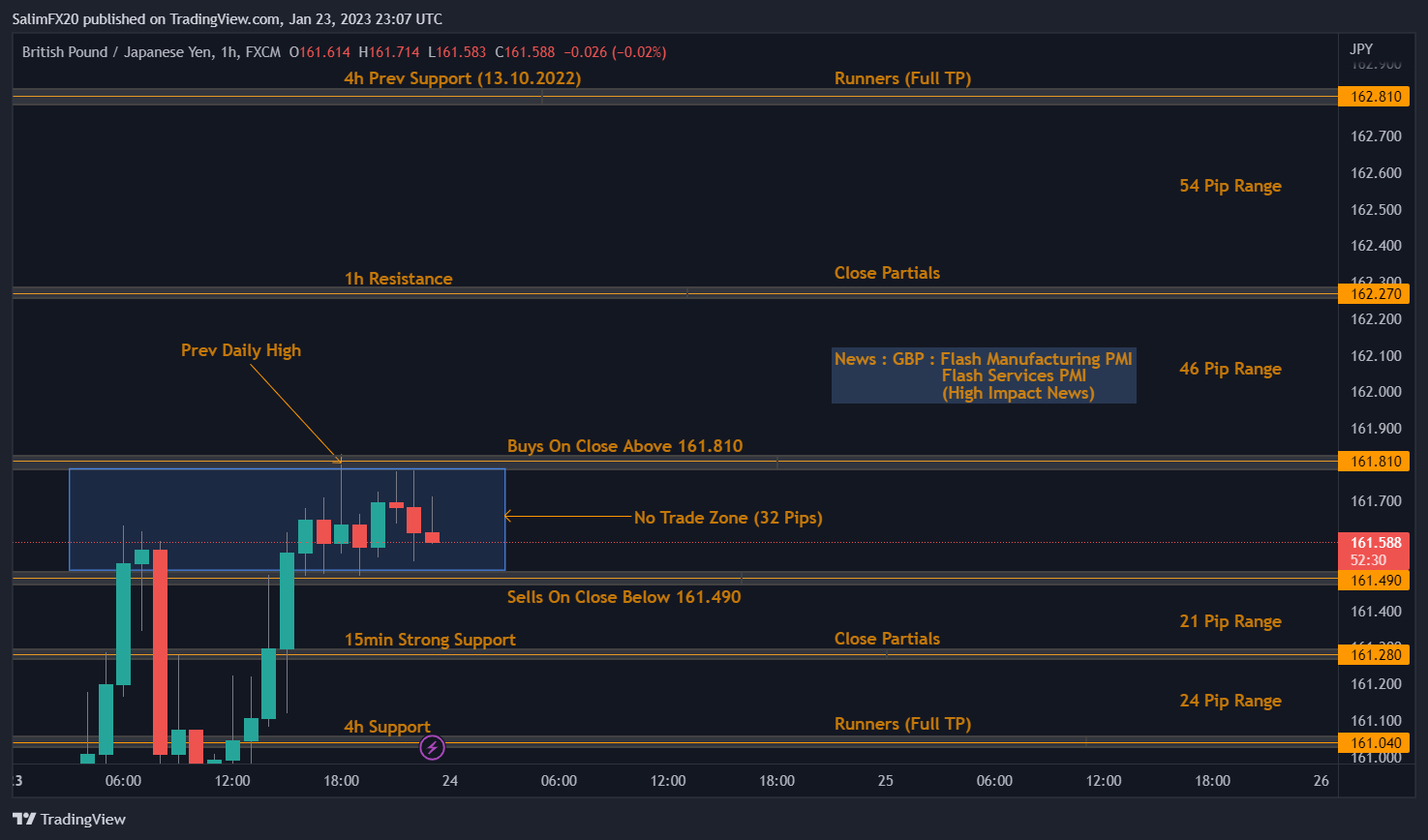

– Buys on close above 161.810 targeting 1h Resistance at 162.720, Leaving Runners to the 4h previous Support formed on 13th October 2022 at 162.810.

– Sells on close below 15min Strong Support at 161.280, Leaving Runners to the 4h Support at 161.040.

– We have Flash Manufacturing PMI and Flash Services PMI data to be released after London open.

– What is Flash Manufacturing PMI ?

– The Flash Manufacturing Purchasing Managers’ Index (PMI) for GBP measures the performance of the manufacturing sector in the United Kingdom. It is based on a survey of purchasing managers, who are asked to rate the relative level of business conditions, including employment, production, new orders, supplier deliveries, and inventory levels. The index is calculated as a weighted average of these indicators, with a reading above 50 indicating expansion and a reading below 50 indicating contraction. The Flash PMI is released on a monthly basis and is considered a leading indicator of economic activity, as changes in manufacturing activity often precede changes in overall economic activity.